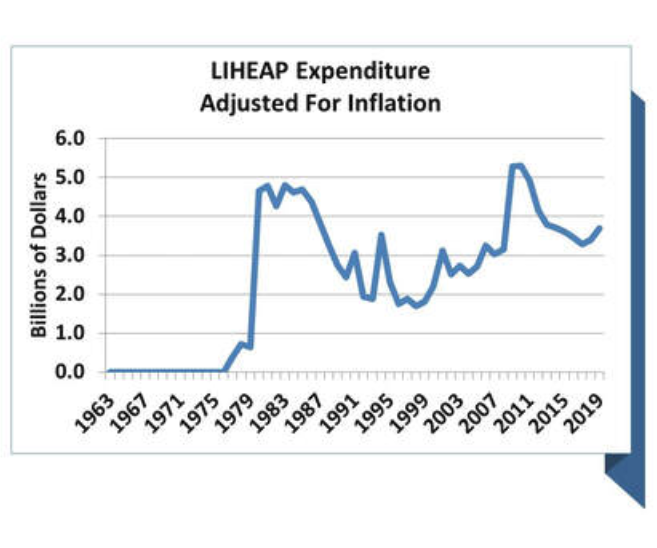

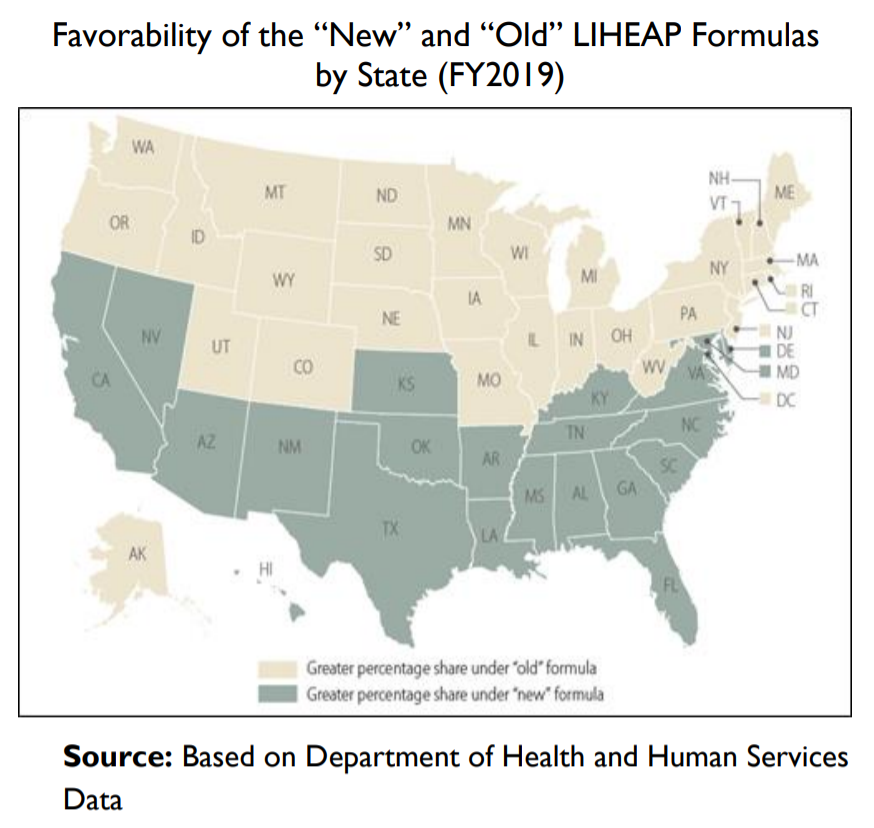

Prior to LIHEAP's inception in 1981, predecessor energy assistance programs focused on the heating needs of colder-weather states in response to high heating oil prices throughout the 1970s. When LIHEAP was adopted, it initally used the multi-step funding formula of LIEAP (the energy assistance program preceding LIHEAP), which again focused on assistance for colder-weather states. The LIHEAP statute specified that states would continue to receive the same percentage of regular funds that they did under the LIEAP, which is referred to as the "old" LIHEAP formula.

When Congress reauthorized LIHEAP in 1984, the program's formula changed by requiring the use of more recent population and energy data, since data were not updated under the "old" formula, and reduced the emphasis on heating needs in order to shift funding to warmer-weather states. In order to prevent a dramatic shift of funds, Congress added two "hold-harmless" provisions to the formula. The percentage of funds that states receive under the formula enacted in 1984 is sometimes referred to as the "new" formula.

There are two funding pools for LIHEAP: regular/formula funds, and emergency contingency funds. The "old" and "new" formulas are used to distribute regular/formula LIHEAP appropriations, while emergency contingency funds may be released to one or more grantees at the discretion of the Secretary of the Department of Health and Human Services (HHS) based on emergency need. The focus of this PECE essay is on regular/formula LIHEAP funds but will include a historical overview of disbursement of emergency contingency funds in the near future.

Sarao, Morgan, “LIHEAP Funding Formulas and Appropriations,” in EVP Research Assistants, The Energy Vulnerability Project, Platform for Experimental and Collaborative Ethnography. (Original, 3 August 2020.)

In August 1981, Omnibus Budget Reconciliation Act, P.L. 97-35, created LIHEAP and replaced it's predecessor LIEAP. It was authorized at $1.85 billion for FY1982-FY1984. In FY1982, Congress appropriated $1.875 billion for LIHEAP; in FY1983, it appropriated $1.975 billion; and in FY1984, $2.075 billion. The funding formula for LIHEAP initially was the same funding formula for LIEAP, and from FY1982 through FY1984, then, states continued to receive the same proportion of funds that they received under the LIEAP formula.

House of Representatives

Efforts to reauthorize LIHEAP had begun in April 1983 with the introduction of the Low-Income Home Energy Assistance Amendments of 1984 (H.R. 2439). As introduced, H.R. 2439 did not contain changes to LIHEAP's funding formula, but the Subcommittees on Fossil and Synthetic Fuels and Energy Conservation and Power collaboratively developed a formula change which shifted funds from states in the Northeast to the South and West. Unlike the formulas under LIEAP, this formula change "used data relating to the most recent year for which data is available.”

To offset the losses some states experienced from the usage of current data, H.R. 2439 also included a hold-harmless provision which ensured that if appropriations were less than or equal to $1.875 billion, states would receive no less than what their allotment would have been under the old formula.

Senate

Before the House could act on their bill, the Senate passed its version of LIHEAP reauthorization as part of the Human Services Reauthorization Act (S. 2565) on October 4, 1984.35 The Senate bill contained language very similar to H.R. 2439, but made the following changes:

The Senate bill also included different authorization amounts for LIHEAP, $2.14 billion for FY1985 and $2.275 billion for FY1986. After S. 2565 passed the Senate, the House debated and passed the bill on October 9, 1984, retaining all the provisions included in the Senate version. The bill became P.L. 98-558, the Human Services Reauthorization Act, on October 30, 1984.

Under P.L. 98-558, sometimes referred to as the “new” LIHEAP formula, there are three different methods to calculate each state’s allotment of regular LIHEAP funds. The calculation method used to determine state allotments depends upon the size of the appropriation for that fiscal year:

Tier I: If the annual appropriation level does not exceed the equivalent of a hypothetical FY1984 appropriation of $1.975 billion, then the allocation rates under the “old” LIHEAP formula apply.

Tier II: If appropriations exceed a hypothetical FY1984 appropriation of $1.975 billion, then new formula rates apply and are used to calculate state allotments. To calculate the new formula rates, the most recent data available are used to determine the heating and cooling costs of low-income households. When appropriations exceed the $1.975 billion level, but are less than $2.25 billion, the new formula rates are used together with the hold-harmless level.

Tier III: If appropriations equal or exceed $2.25 billion, the new rates apply and both the hold-harmless level together with the hold-harmless rate are in effect.

Appropriations for regular LIHEAP funds only exceeded the equivalent of a hypothetical FY1984 appropriation of $1.975 billion in 1985 and 1986 until FY2006; therefore, from FY1987 through FY2005, and again in FY2007, states continued to receive the same percentage of LIHEAP funds that they received under LIEAP.

FY2006: $2.48 billion appropriated, leading to funds being distributed under Tier III of the funding formula

FY2008: In FY2008, the Consolidated Appropriations Act (P.L. 110-161) failed to authorize a set-aside called leveraging incentive grants. As a result, the funds for those grants were added to the LIHEAP regular funds, triggering use of new formula data.

FY2009: The Consolidated Security, Disaster Assistance, and Continuing Appropriations Act (P.L. 110-329) appropriated $4.51 billion in regular funds. However, the law further specified that $840 million be distributed according to the "new" LIHEAP formula, with the remaining $3.67 billion distributed according to the percentages of the "old" formula established by LIEAP

FY2010: From FY2010 through the present, Congress has continued to appropriate funds using a version of a split between the "old" and "new" formulas.

Hold-Harmless Level: Applied if the regular LIHEAP appropriation exceeds the equivalent of a hypothetical FY1984 appropriation of $1.975 billion. Under these scenarios, a hold-harmless level applies to ensure that certain states do not fall below the amount of funds they would have received at the equivalent of the hypothetical FY1984 appropriation of $1.975 billion.

Hold-Harmless Rate: Applied along with the hold-harmless level if appropriations for LIHEAP are at or above $2.25 billion. Under the hold-harmless rate, states that would have received less than 1% of a total $2.25 billion appropriation must be allocated the percentage they would have received at a $2.14 billion appropriation level, assuming the percentage at $2.14 billion is greater than the percentage originally calculated at the hypothetical $2.25 billion appropriation. Then that state will receive the percentage share of funds it would have received at $2.14 billion for all appropriation levels at or above $2.25 billion.